Fast, Accurate AML/KYC for Fintechs

Compliance that scales with your business and integrates with your existing stack

94%

Fewer false positives

83%

Less time on L1 alert reviews

5 minute

Data update cycle

Scale onboarding and payments without compliance bottlenecks

Instant Risk Detection at Scale

Instantly identify high-risk payment, account and customer activities with AI-powered screening built for fast-moving fintech environments and high transaction volumes.

Integration in days, not months

Plug directly into your payment processors, onboarding flows and case management systems. Castellum.AI can work with your existing tools - not against them. No rip-and-replace.

Audit-Ready Documentation

Every alert, decision and disposition is logged, timestamped and searchable, giving you clear and explainable documentation for auditors and regulators.

Resolve L1 and L2 alerts. Agents provide documented, auditable reasoning that auto-escalates to human analysts when additional expertise is needed.

Save time and money. Castellum AI agents use our data - no need to go to other providers, sign more SLAs and worry about latency. It’s all in house.

For your organization only. Agents are trained on your AML/KYC policies and procedures for consistent, accurate and reliable alert adjudication that you can count on.

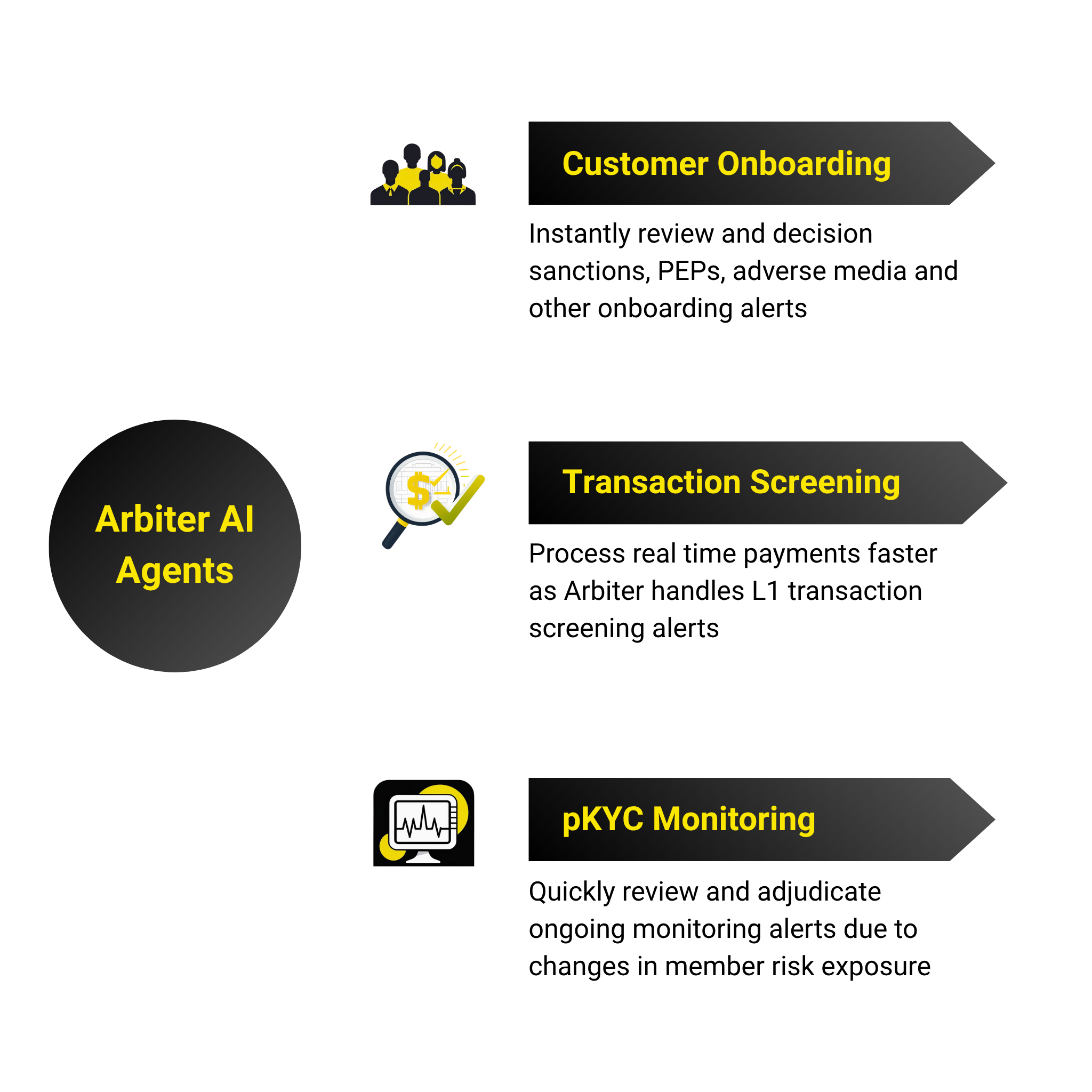

Automate L1 and L2 alert reviews with AI agents

Our AI agents reduce compliance backlogs by instantly addressing risk alerts, using real-time data and regulatory guidelines.

Your end-to-end compliance solution

Arbiter: AI Agents for FinCrime

Resolve L1 and L2 alerts for onboarding, transaction screening, pKYC and more in less than a second.

Learn more

AI-Powered Adverse Media

Exceptionally reliable results that lead to higher value alerts and faster alert reviews.

Learn more

Transaction screening

Screen large transaction volumes in real time against global risk data with 94% less false positives.

Learn more

Enriched Sanctions and PEPs Data

Detect real threats, not people with similar names —screen 1,000+ watchlists updated every 5 minutes.

Learn more

Real-time monitoring

Never see the same alert twice and receive instant notice of changes in a customer’s risk profile.

Learn more

How Lead Bank cut false positives in half with Castellum.AI

From alert overload to scalable screening — Learn how Lead Bank restructured its screening program across sanctions and PEP workflows, from initial challenges through vendor evaluation, implementation and operational impact.

“Castellum.AI is one of the most nimble vendors I’ve ever worked with, and they care about your ideas. Unlike other providers where you submit a ticket and wait weeks for a response, the team is always readily available for assistance and technical support. They put out a great product that allows us to truly own the risk and the process.”

Backed by investors representing 100+ financial institutions

Ready to get started?

See how we help compliance teams at financial institutions quickly identify risk